Government Lies, Corruption and Mismanagement

Roslyn, Long Island: A Look Inside the Fraud of Public School Education

New York State Comptroller Alan Hevesi finds that the corruption in the Long Island New York school district is bigger than previously disclosed. We must study the lesson taught here: our public school system needs oversight, transparency, and accountability. Betsy Combier

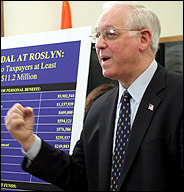

NYS Comptroller Alan Hevesi

Audit Describes 8 Years of Theft at L.I. School District

By BRUCE LAMBERT, NY TIMES

For eight years, the top officials of an affluent Long Island school district systematically plundered taxpayer funds, illegally diverting at least $11.2 million to themselves, relatives and cronies for an array of goods and services, from a 65-cent bagel to a $1,812-a-night hotel suite to a mortgage on a luxury home in Florida, a new state audit says.

The scandal, in Roslyn, N.Y., is the most pervasive such school fraud in the country, say officials from the National School Boards Association. The year-old case has already had repercussions in districts throughout New York State, where school officials and bookkeepers say they are paying closer attention to budgets and accounts, and state auditors have stepped up their scrutiny.

The report, issued yesterday by the state comptroller, Alan G. Hevesi, examines the district's records from 1996 to 2004, and it reveals far deeper and wider corruption than previously disclosed. It found losses of $3 million more than was estimated last spring, when the first allegations became public. It also documents and analyzes unauthorized spending and account manipulation well beyond what school officials and the district attorney had previously detailed.

Besides using district funds to cover $1.1 million in cash withdrawals on personal credit cards, district officials shopped extravagantly at taxpayers' expense, the records show. The purchases included $18,605 for artwork from Galerie Lassen on Maui in Hawaii, $14,033 for pet supplies, $19.95 for vitamins, $81,637 to repay a college loan, $3.05 for a latte and $4,045 to a company for such merchandise as a manicure and pedicure kit, a Sony shower radio and an Aquabot Ultra Pool Cleaner with remote control.

The losses went undetected for so long, officials have speculated, because of Roslyn residents' pride in the district's stellar academic achievements. The district, on Long Island's North Shore, has 3,300 students and a 95 percent graduation rate, and a healthy share of its graduates go off to Ivy League colleges every year. The superintendent at the time, Frank A. Tassone, also had impressed and charmed the school board and parents.

Criminal investigations have already led to grand larceny indictments of Dr. Tassone and the district's former business manager and a former clerk, all of whom have pleaded not guilty. Prosecutors said they were reviewing the latest findings and considering further charges.

Dr. Tassone's lawyer, Ed Jenks, said he had not seen the audit but argued that many expenses were legitimate. "He was allowed one international trip a year," he said. "It doesn't say in the contract whether he can take the Concorde or swim across the Atlantic."

The audit also said there were 26 additional beneficiaries, and it hinted that sharing in the money might have tempered some district employees' enthusiasm for blowing the whistle. The auditors cautioned, however, that at least some of the beneficiaries might have been innocent recipients of gifts.

Those gifts were at the expense of taxpayers; the property tax for homeowners in Roslyn averages $9,700 a year. In four years, the district's tax levy rose by half, from $46 million in 2000 to $69 million in 2004.

"Taxpayers are furious, and they have a right to be furious," Mr. Hevesi said at a news conference in Garden City, N.Y., hours before making an unusual presentation of the audit to residents at the high school last night.

"We're going to clean this up," he said. "We're going to put the systems in to make sure this never happens again."

One indignant parent who turned out for Mr. Hevesi's briefing said she wanted everyone involved to be punished.

"The degree of the embezzlement is so massive, the scope and magnitude of this is horrific," said the parent, Jeannette Elsner, one of about 200 residents at the 7:30 p.m. meeting. "It sickens me."

The audit concluded that Dr. Tassone took a total of $2.4 million, and his former assistant superintendent for business, Pamela Gluckin, was responsible for $4.6 million in unauthorized spending. Ms. Gluckin's lawyer did not return a call seeking comment.

The audit specified items large and small and even farfetched. For example, the audit said, Ms. Gluckin used $935,831 in district money to pay the mortgages on three homes. But she also charged for the flood insurance for her Hamptons house and her $989 water bill in Bellmore.

The means varied. The audit said they included billing personal items to taxpayers, credit card fraud and fraudulent salary reports to the pension system that inflated retirement payments. More than $1 million in business contracts were awarded to friends and relatives with "no record that the district received anything of value in return," the report said. A total of $549,129 went for illegal raises and bonuses and other benefits.

Taxpayers paid $549,120 for food and catering; $249,883 for computers and other electronic equipment; $160,171 for life, homeowner's, car and boat insurance policies; and $206,798 to buy or lease cars, including a BMW and a Jaguar.

The car payments were in addition to the $230,000 that Dr. Tassone was accused of taking before he resigned last year, a $17,200 annual car allowance and $42,000 for several years of parking in Manhattan, where he lived.

Taxpayers also covered: $37,385 in dry cleaning bills, $3,471 for cable television, $5,236 for Dr. Tassone's Christmas cards and overtime for a clerk to prepare them, 965 personal Federal Express deliveries, $20,686 for rugs and furniture, a $4,890 brunch for 40 at Pulse in Rockefeller Center, $45,700 for jewelry, $7,550 for tailoring and an unspecified $4,500 bill at the Mandalay Bay casino resort in Las Vegas. The district also paid for Sony Playstations and telephones in Colorado and Pennsylvania.

"I find this to be quite breathtaking and remarkable, one of a kind," Mr. Hevesi said at the news conference in the Garden City office of District Attorney Denis Dillon.

One startling revelation was that Dr. Tassone and Ms. Gluckin got the school district to pay not only for their personal credit card purchases but also for more than $1 million in cash withdrawals from automated teller machines. Dr. Tassone, who had 24 credit cards, averaged $700 in withdrawals a day for 20 months. In May 2002, he averaged $1,117 a day. Ms. Gluckin, who had 23 credit cards, averaged $1,270 a day in February 2002, according to the report.

The audit concludes that the corruption was enabled by an utter breakdown of the normal safeguards in the system. The school board failed its oversight duty to impose policies and procedures, it said. The administrators were perverting the system for their own profit, according to the report. The treasurer and internal staff auditor failed to do their jobs, and the external accounting firm missed what was happening and was itself involved in conflicts of interest, the report said.

The accountants, Miller, Lilly & Pearce, which also served 55 other districts and whose related firm sold financial software to 250 districts across the state, recently closed.

"No one was watching, and those who were supposed to be watching did not, for whatever reason," Mr. Hevesi said.

Since the Roslyn debacle, the comptroller has given seminars to school officials around the state and has also asked for $5 million to resume regular school audits, which ended two decades ago in a budget cut.

The seven-position Roslyn school board, which has four new members and a new president since district voters rebelled last year, has promised to follow all 27 of the state's recommendations. The board president, Stanley Stern, praised the comptroller yesterday for having "done a great service."

Perhaps most damning was that the school board covered up an early warning, the discovery three years ago that Ms. Gluckin had taken $223,000. The board allowed her to repay the money and quietly leave, without any report to the public, criminal sanctions or any further investigation.

The failure to take proper action then may preclude the school district from recovering any of the losses from its insurance carrier, the state report said. Assistant District Attorney Peter Mancuso said his office was pursuing forfeiture and restitution remedies.

As Mr. Hevesi neared the end of his listing of abuses at his news conference, he apologized for taking so long and said: "It's almost therapeutic."

Patrick O'Gilfoil Healy, in Roslyn, and David M. Herszenhorn, in New York City, contributed reporting for this article

March 3, 2005

Formula for Fleecing a School District? Spreading Cash Around, Audit Says

By MICHELLE O'DONNELL, NY TIMES

LINK

The formula for stealing $11.2 million from the Roslyn school district was simple: by compromising the district's accounting controls and giving bonuses to almost everyone who had oversight of the spending, two top officials were able to quietly embezzle the funds over eight years without triggering any alarms, according to a searing audit.

The audit of the district was released yesterday by State Comptroller Alan G. Hevesi. According to it, the scheme involved the former superintendent, Frank A. Tassone; the former business manager, Pamela Gluckin; and an accounting clerk, Debra Rigano, who is a niece of Ms. Gluckin. They have all been accused of grand larceny. Other employees who received the largess, which included unauthorized extra pay, might have been innocent recipients, Mr. Hevesi cautioned, but the criminal investigation is continuing.

More than half the money was embezzled in a scheme in which Dr. Tassone and Ms. Gluckin and nine of their family members and friends charged $5.9 million for personal items and cash advances on 74 personal credit cards, investigators said. Then Ms. Gluckin, who resigned in 2002, and Dr. Tassone, who resigned last June, used district checks to pay those bills, Mr. Hevesi said.

The audit found that Dr. Tassone and Ms. Gluckin would obtain cash advances on their credit cards at A.T.M.'s. Ms. Gluckin, whose salary and benefits in her final year were $87,250, charged $559,176 in cash advances to the district over six years. Dr. Tassone, who received a salary of $230,000, charged $541,596 to the district in cash advances.

Once the cash advances and the credit card charges - among them, for Tiffany and Tourneau jewelry, Coach leather accessories, carpet and furniture for him; and clothes from Nordstrom and Sears, electronic equipment, pet supplies and art and furniture for her - were executed, those amounts were submitted to the district, the audit said.

To pay those bills, district checks were sent directly to the card issuers. The audit found that the district's financial software could be easily manipulated and had fraud controls that had never been activated. Using a legitimate vendor account number, the name of the check's recipient would be changed from a vendor of school supplies to the creditors. After the check was issued, the name of the payee would be changed back in the computer records to the legitimate vendor to conceal the fraudulent payment, according to the audit.

For example, personal American Express payments totaling $1.49 million were paid under the vendor number of Sargent-Welch, the company that provided the district with laboratory supplies. Payments to Citibank totaling $896,730 were made under the vendor number of the Nassau County Board of Cooperative Educational Services, which provides special education programs.

Mr. Hevesi said that vulnerabilities in the district's financial software, Finance Manager, which is in use in 251 school districts in the state, allowed the officials to disguise their thefts as legitimate spending.

In a separate audit last month, he faulted the district's outside accounting firm, Miller, Lilly & Pearce, for "appallingly inadequate" audits.

When a budget category came close to its limit, the audit said, school officials were able to shift funds among accounts. Dr. Tassone had been granted unlimited authority by the school board to make those transfers even though state education regulations required the board to set limits on the amounts that can be transferred without board approval, according to the audit.

No check warrants - lists of payments awaiting approval by the district's internal claims auditor - were maintained. In fact, the audit found, the claims were barely reviewed by that auditor. The extent of the review by the internal auditor, an acquaintance of Dr. Tassone who received $6,200 in unexplained payments from the district, consisted of thumbing through and initialing the vouchers, the audit said.

The district's treasurer, who is the custodian of all district funds, rarely attended board meetings and infrequently reported on the budget, the audit said. Although state law requires that a district's checks are to be signed by the treasurer, in Roslyn, the checks were signed by Dr. Tassone's secretary.

Dr. Tassone and Ms. Gluckin consolidated their control over the district's finances by installing clerks responsible for monitoring both accounts payable and accounts receivable. Standard accounting practice is to separate those duties to prevent fraud, according to the audit.

JUNE 2004 DA Announcement

Office of the Nassau County District Attorney

LATE FINAL

Weighing the Impact of N.Y. Schools' Scandals

Allegations that schools administrators in separate incidents stole at least $2.7 million from two districts in New York's Long Island are reverberating with calls for much tighter fiscal controls at districts throughout the state. So far, though, the impact appears limited to New York.

The scandals erupted in February in Roslyn, an upscale community on Long Island's North Shore, where former Superintendent Frank Tassone and Chief Financial Officer Pamela Gluckin were charged with stealing $2 million in district funds. Gluckin allegedly spent $1 million of district money on waterfront homes, boats and luxury cars while Tassone allegedly used district money for vacation and jewelry.

At press time, Tassone had an August criminal court date scheduled, while Gluckin is to appear in criminal court Sept. 20.

After the allegations against Tassone and Gluckin came to light, a suspended supervisor of buildings and grounds for the Roslyn district, Thomas Galinski, stepped down from his job in July after officials found evidence that he billed the district for personal trips.

In another district, William Floyd Schools in Suffolk County, former treasurer James Wright was charged with allegedly stealing at least $700,000 in school funds. He is expected to appear in court at a later date.

Despite the apparent involvement of at least several officials in the Roslyn system, the problems appear to have gone unnoticed for so long due to the district's strong performance in standardized testing over the years and in turning out graduates who went to college.

When auditors first discovered that Gluckin had allegedly embezzled money, the Roslyn school board accepted her resignation on condition that she return the $250,000 believed to have been taken, Newsday reported. The allegations against Tassone emerged in an anonymous letter to the district in February.

In July, a task force assembled by the Suffolk County School Superintendents Association issued a report with recommendations for tighter fiscal controls to help prevent a recurrence of the financial scandals.

Among its recommendations are calls to better educate school boards on understanding financial documents. The association also calls for school boards to avoid conflicts of interest with financial auditors by not involving them in accounting tasks they would later be asked to audit.

Such conflicts of interest "tend to happen over the course of the year because you establish a relationship with your auditor," says Gary Bixhorn, president of the Suffolk County superintendents group.

The association also called for an independent audit of every New York school district by the state comptroller's office every five years.

Bixhorn says the dramatic events in Roslyn were certain to gain national attention. But he stopped short of predicting that districts across the country would review their processes with the kind of intense self-scrutiny and public meetings that have marked many of Long Island's 125 districts since the scandals.

Paul Houston, executive director of the American Association of School Administrators, says the Long Island scandals, particularly in Roslyn, did not pose the risk of a national epidemic because they were so "over the top."

"The good news clearly is that these are fairly isolated incidences," Houston says. "The bad thing is that there is a lot of anger on the part of a lot of the superintendents [nationwide]; they're sort of tarnished by what a few did."

--Allan Richter

March 4, 2005

School District May Have Hard Time Recovering Losses

By PATRICK O'GILFOIL HEALY, NY TIMES

LINK

ith the release of a long-awaited state audit on Wednesday, prosecutors and local officials have an intricate map tracing how $11.2 million was looted from the Roslyn school district. Now they face the difficult job of recovering the money.

"There shouldn't be a dime that doesn't come back to this district," said State Senator Michael Balboni, a Republican of East Williston, N.Y., reacting Wednesday night to a new state audit that described eight years of brash and sweeping fraud. "Not a dime."

But Nassau County prosecutors and officials from other school districts that have been victims of fraud suggest that Roslyn faces a long, hard slog to get its millions back.

Some of the money has evaporated, gambled away in Las Vegas or spent on Caribbean vacations, expensive dinners and flights on the Concorde. And hundreds of thousands of dollars were invested out of state in homes in Pennsylvania and Florida, which the authorities say is likely to complicate efforts to recover the money.

So far, officials in the Civil Forfeiture Unit of the Nassau County district attorney's office have filed $4.4 million in claims against the three people charged in the scandal: Roslyn's former superintendent, Frank A. Tassone; the former assistant superintendent for business, Pamela Gluckin; and Ms. Gluckin's niece, a former district clerk, Debra Rigano. All have pleaded not guilty to charges of grand larceny.

Investigators have frozen bank accounts, put liens on homes and sent letters demanding that tainted money be returned to prosecutors. Robert Nigro, chief of Nassau's forfeiture unit, said prosecutors would seek more money as the criminal case unfolded, closing a $7 million gap between what was taken and what prosecutors were already trying to recover.

"There's a lot of grist for our mill," Mr. Nigro said.

The school district is also suing its former auditor, Miller, Lilly & Pearce, for $12 million, accusing the now-defunct auditing firm of negligence for allowing the thefts to go undetected. It has filed a $1 million lawsuit against Ms. Gluckin. The district is also fighting to get insurance money to cover part of the theft.

Stanley Stern, the school board president, said Roslyn had hired a Uniondale law firm solely to go after the district's missing millions.

The audit released Wednesday, by State Comptroller Alan G. Hevesi, described thefts and spending that circled the globe. It accused school officials of using school money to cover $1.1 million of cash withdrawals on personal credit cards and to pay tens of thousands of dollars on college loans and for artwork, vitamins, electronics and a pool cleaner.

The district's money trickled down to nearly 30 people, many of them friends and family members of Ms. Gluckin, Mr. Tassone and Ms. Rigano, the audit found. The audit said that Ms. Gluckin received $4.6 million in school money; Mr. Tassone, $2.4 million; and Ms. Rigano, $334,452.

So far, prosecutors have filed claims totaling $2.5 million against Ms. Gluckin. They have taken out liens against her houses in Bellmore and West Islip, and have a lien on her husband's business, Spin City, a laundry in Holbrook.

Ms. Gluckin's Bellmore home, where she lives, is now up for sale, and a sale of her West Islip home for $1.45 million is pending, prosecutors said. She has already agreed to deposit $1 million more into a trust held by her lawyer and lawyers for the school district, according to prosecutors.

The millions seized from the defendants will remain invested or be put into escrow accounts until the criminal cases are settled, prosecutors said. Ms. Gluckin, Mr. Tassone and Ms. Rigano will get their money back if they are acquitted. If they are convicted or plead guilty, the money will be returned to the school.

Prosecutors have filed an order of attachment seeking $1.3 million from Mr. Tassone. They said they believed he had $660,000 in cash and stocks and $498,000 more invested in accounts held by his two sisters.

Finally, prosecutors have filed a claim of $581,051 against Ms. Rigano.

Roslyn may get an idea about its future from the travails of the South Worcester School District in Massachusetts, where the former assistant superintendent of business spent $5.4 million on gambling and his horse stables. The scandal erupted in 2000, and five years later, the district has been able to recoup only $500,000 from the former official.

The superintendent, Steven Mondor, said the district survived the scandal by being honest and contrite with residents. It took out a $5 million loan to cover its losses and asked that voters not punish students by voting against school budgets. All of its budgets have passed, and the district has paid off $3.6 million of the 10-year loan, he said.

Roslyn, Long Island's Culture of 'Permissive Spending'

Roslyn, Long Island, NY: The Enron of Education Fraud and Corruption

Roslyn's Corruption Has Long-Term Effect on Long Island and the US

Resident Reponds to Accusations

LINK

Resident Responds to Letter

On May 14, Dr. Frank Tassone and the Roslyn Board of Education mailed a third letter to the entire school district to "dispel" some rumors they claimed were circulating. The letter contained no new information. Here is my take on these rumors:

Rumor: The district has not taken action to recover the stolen money.

Opinion: The district only took action in 2004 when it became public knowledge that Pamela Gluckin had embezzled far more money than they had recovered in 2002. In 2002, they never notified the insurance company nor did they initiate a more extensive audit that might have revealed the extent of the theft.

Rumor: The board could have prevented the former assistant superintendent from receiving her pension.

Opinion: Had the board reported Gluckin to the district attorney in 2002, the pension might have been put on the table in negotiating a settlement and likely would have been sacrificed by Gluckin.

Rumor: The board made an agreement with Pamela Gluckin to keep the matter quiet.

Opinion: A verbal "understanding" was entered into allowing Gluckin to quietly retire. The board protected her and itself by spreading the rumor that she retired due to illness.

Rumor: The board has withheld the name of the attorney who advised them that it was not required to report the theft to law enforcement authorities.

Opinion: Both Mr. Hession and the board's attorneys advised that reporting was not mandatory either to the authorities or to the community whose money had been stolen and who was paying for these consultations. Neither firm recommended checking the insurance policy to determine if a claim must be made. Both firms were negligent. Since when does Dr. Tassone or the board need legal advice to determine whether it is morally, ethically and legally necessary to report a felony to the criminal authorities?

Rumor: The board does not want community oversight of the district's finances.

Opinion: Restoring community confidence in the board should start with complete transparency for all expenses, starting with the current budget. Itemize all accounts.

Rumor: The district's taxpayers will be responsible for additional costs related to this investigation.

Opinion: The $58,000 has been our expenses to date. The same firm that did not advise reporting the felony in 2002 has earned $30,000 to date and represents the district in a civil suit which has only just begun and could take years. "Communication" expenses for a public relations firm (CJS) to deal with the media have cost us $8,000 to date. From what part of the budget are these expenses coming? How much more will we have to pay?

Rumor: The board and Dr. Tassone have apologized to the community for abdication of their fiduciary and moral responsibilities.

Opinion: While admitting "a mistake in not disclosing this matter when it was first uncovered," no apology has ever been made.

Rumor: The board is registering high school seniors 18 years old to vote and discussing which programs would be cut if the budget does not pass.

Opinion: Board members discuss registering to vote annually, but this year the assistant superintendent, Mr. Celano, has lectured to several senior social studies classes about voting and what would be cut if the budget fails. Is this not manipulation of a captive audience by a high level administrator?

Rumor: The PTA presidents represent their membership when they publicly endorsed the budget.

Opinion: The PTA presidents represent only themselves and not their respective organizations. They did not contact their membership to see if there was a majority of parent members who wanted the budget to pass. They are using the PTA name and funds inappropriately.

A Roslyn Parent

Mineola, New York, School District Administrator John Jackson Is Indicted